Debunking Foreclosure Fears: No Foreclosure Flood Ahead

The current trend of escalating costs across various sectors, ranging from groceries to fuel, has sparked concerns about the possibility of a growing number of individuals struggling to meet their mortgage obligations. This has led to speculation about an impending wave of foreclosures. However, while there has indeed been a slight increase in foreclosure filings compared to the previous year, experts are advising against the expectation of a massive surge in foreclosures.

Bill McBride, a reputable authority on the housing market renowned for accurately predicting the 2008 foreclosure crisis due to his meticulous analysis of data and market dynamics, holds a different perspective this time:

"Contrary to previous occurrences, There will not be a foreclosure crisis this time."

Let's delve into the reasons behind the diminished likelihood of another foreclosure wave.

Limited Number of Homeowners Significantly Behind on Mortgage Payments

One of the primary factors that contributed to the high foreclosure rate during the previous housing crash was the lax lending standards that enabled individuals to secure mortgages even without demonstrating their ability to repay them. During that era, lenders were lenient when evaluating applicant credit scores, income levels, employment statuses, and debt-to-income ratios.

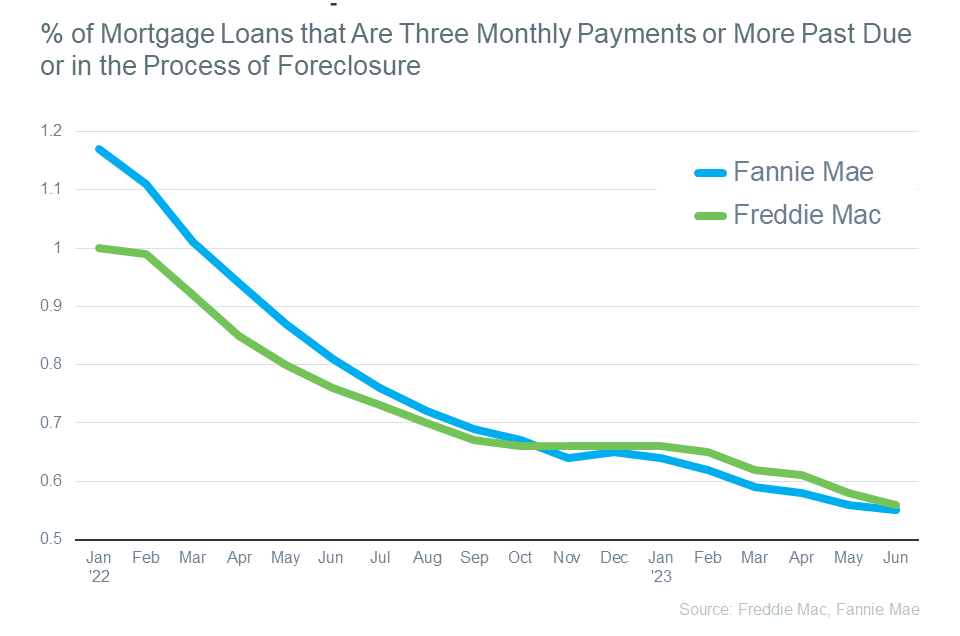

Today, the lending landscape has undergone a significant shift, resulting in more stringent lending standards. As a result, a higher proportion of buyers now possess the financial capacity to fulfill their mortgage commitments. Data provided by Freddie Mac and Fannie Mae underscores this positive trend, revealing a decline in the number of homeowners who are significantly behind on their mortgage payments (refer to the graph below):

Molly Boese, Principal Economist at CoreLogic, offers insight into the limited extent of homeowners facing mortgage payment challenges:

“May’s overall mortgage delinquency rate matched the all-time low, and serious delinquencies followed suit. Furthermore, the rate of mortgages that were six months or more past due, a measure that ballooned in 2021, has receded to a level last observed in March 2020.”

For a notable increase in foreclosures to occur, there would need to be a substantial rise in the number of individuals unable to meet their mortgage obligations. Given the current strong performance of mortgage payments by a significant number of buyers, the likelihood of a foreclosure surge is minimal.

In Conclusion If concerns about an impending flood of foreclosures are troubling you, rest assured that the available data does not support this notion. In fact, a substantial portion of qualified buyers are consistently honoring their mortgage commitments at an impressive rate.

Categories

- All Blogs (910)

- Airway Heights (5)

- Audubon/Downriver (4)

- Balboa/South Indian Trail (5)

- Bemiss (3)

- Browne's Addition (3)

- Buying Your Home in Spokane (207)

- Cheney (3)

- Chief Garry Park (3)

- Cliff-Cannon (3)

- Colbert (1)

- Comstock (4)

- Cost of Living in Spokane (1)

- Dishman (3)

- Downtown Spokane (1)

- Driving Tours (1)

- East Central (3)

- Emerson/Garfield (3)

- Five Mile Prairie (5)

- Grandview/Thorpe (3)

- Greenacres (3)

- Hillyard (3)

- Home Improvement (8)

- Home Prices (5)

- Housing Inventory (6)

- Housing Market (133)

- Housing Market Update (2)

- Instagram Videos (2)

- Interest Rates (24)

- Job Market in Spokane (3)

- Know Spokane (608)

- Latah Valley (5)

- Liberty Lake (8)

- Lincoln Heights (4)

- Living in Spokane (2)

- Logan (3)

- Manito-Cannon Hill (3)

- Medical Lake (4)

- Minnehaha (3)

- Moran Prairie (3)

- Mortgage (26)

- Moving out of Spokane (3)

- Moving to Spokane (143)

- Nevada/Lidgerwood (3)

- New Construction Homes in Spokane (1)

- New Construction Opportunities (3)

- North Hill (3)

- North Indian Trail (4)

- Northwest (3)

- Opportunity (3)

- Peaceful Valley (3)

- Riverside (3)

- Rockwood (4)

- Selling Your Spokane Home (163)

- Shiloh Hills (3)

- Southgate (3)

- Spokane Events (447)

- Spokane Neighborhoods (51)

- Spokane Restaurants/Food Places (24)

- Spokane Schools (12)

- Spokane Valley (14)

- Suncrest (1)

- Things to Do in Spokane (460)

- Veradale (3)

- West Central (3)

- West Hills (3)

- Whitman (3)

- Youtube Videos (49)

Recent Posts