Top 3 Neighborhoods to Invest in Spokane, WA

Are you looking to invest in real estate this year in the Spokane, WA area while the market is down? Well lucky for you I have spent a lot of time crunching the numbers to find out which neighborhoods in Spokane are most likely to cash flow so that you don’t have to, let’s get into!

So I’ve spent some time doing a couple of things to determine the best neighborhoods to purchase a rental property here in Spokane.

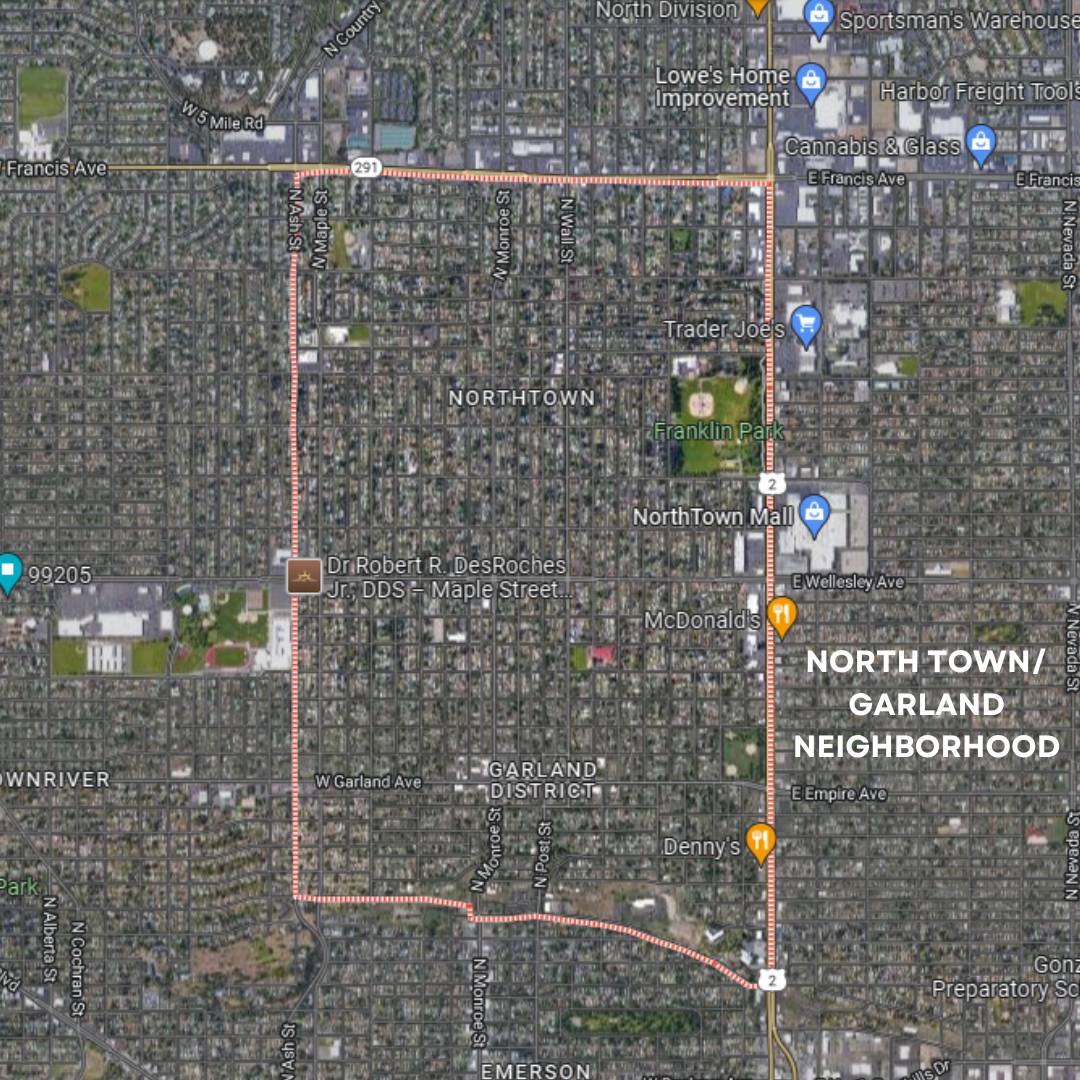

The first was breaking up Spokane into easy neighborhoods to look at. There’s dozens of neighborhoods in Spokane but we’ll just be focusing on some of the larger ones to get a bigger picture of each pocket of Spokane.

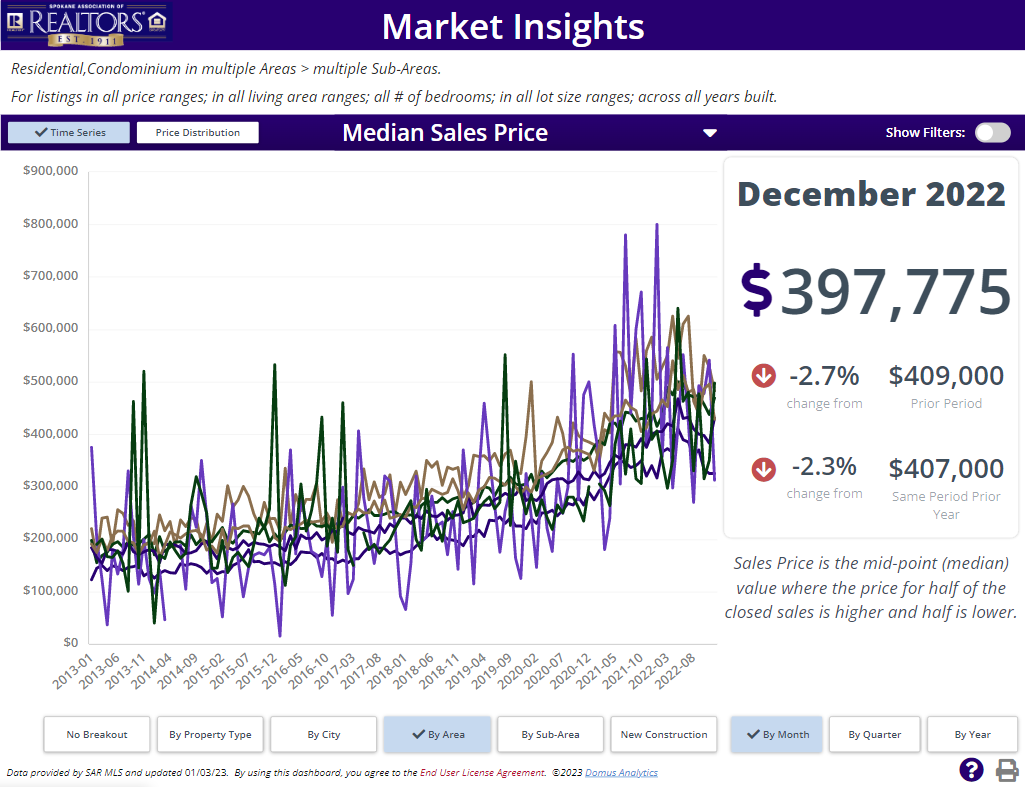

Then I looked at the median home price in each of those neighborhoods, and I look at median because it gives a more accurate picture of what is going on in that area. The average can more easily be skewed by a really high or low sale in the neighborhood.

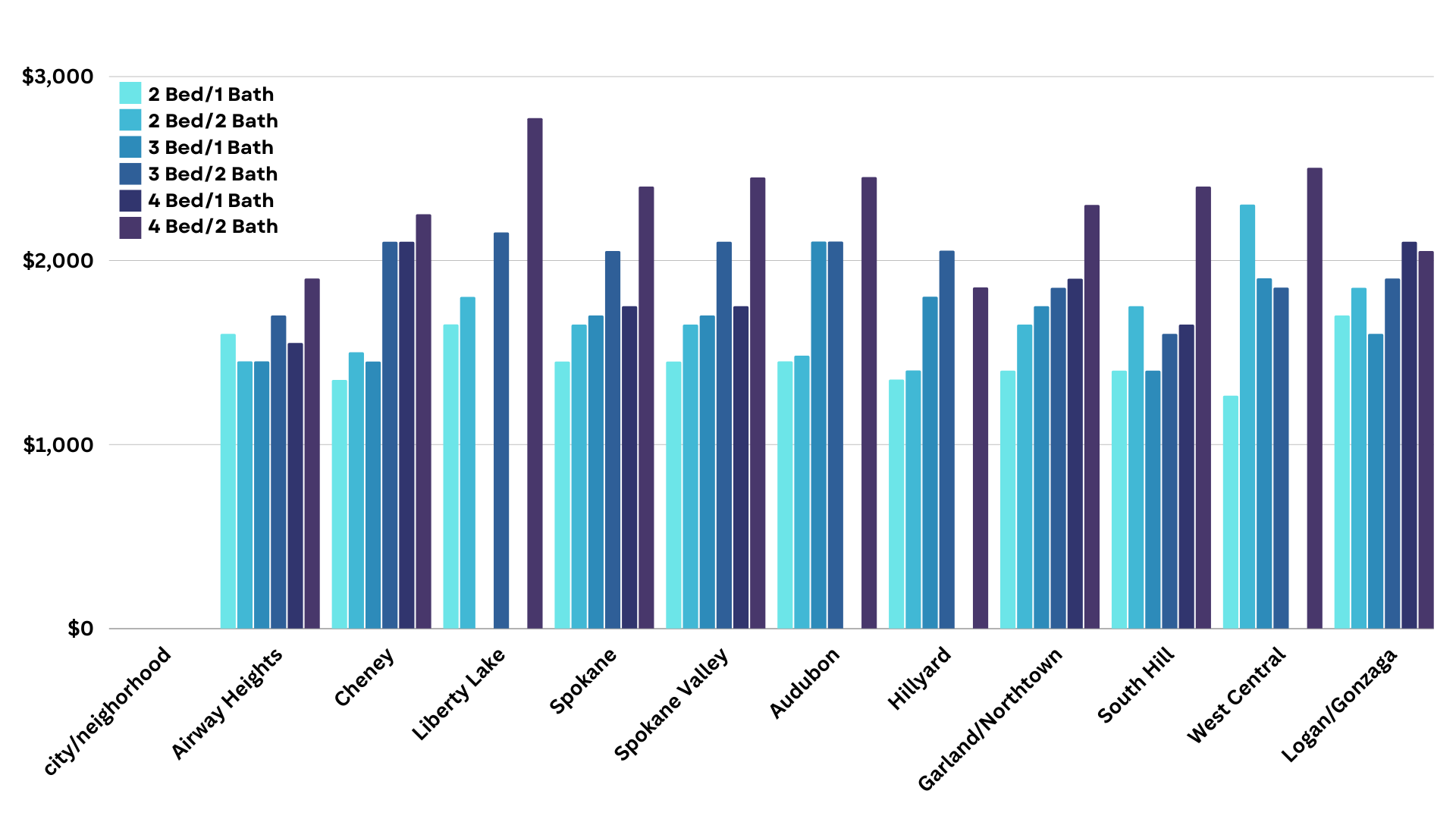

I was able to find rental comps using the tool, rentometer, which yes it is rentometer, not Rent O Meter because you have a speedometer in your car not a SPEED O METER.

Then taking the median home price and the rental comps, I was able to determine what the cashflow rate would be. Many of us Biggerpockets fans have heard of the 1% rule as being a guiding light for finding a great rental property. And of course it’s a good metric to start with and decide if it’s a property to pursue but it’s not the end all be all. Some properties have many more expenses, some will never appreciate so even though the cash flow is nice, you won’t actually be building any wealth.

Well, just to cut to the chase a little bit, you won’t find a property in Spokane that makes the 1% rule on the MLS. And I should probably bite my tongue because I’m sure someone did it in the last 12 months and if you did, good on you, I’m very impressed. But for the most part, finding a property in Spokane that hits that rule takes a ton of effort to find off-market where you’ve found a seller willing to let go of their property for a discount.

So overall, Spokane isn’t an amazing market for cash flow and large cash on cash returns if you’re getting a mortgage on the property. But if you’re someone who is buying the property in cash and just wants to protect your money from inflation, then the appreciation you get out of a Spokane property can be well worth it.

So, what are the top neighborhoods in Spokane to buy a cash flowing rental property? Let me know in the comments below where you’ve found the best cash flow!

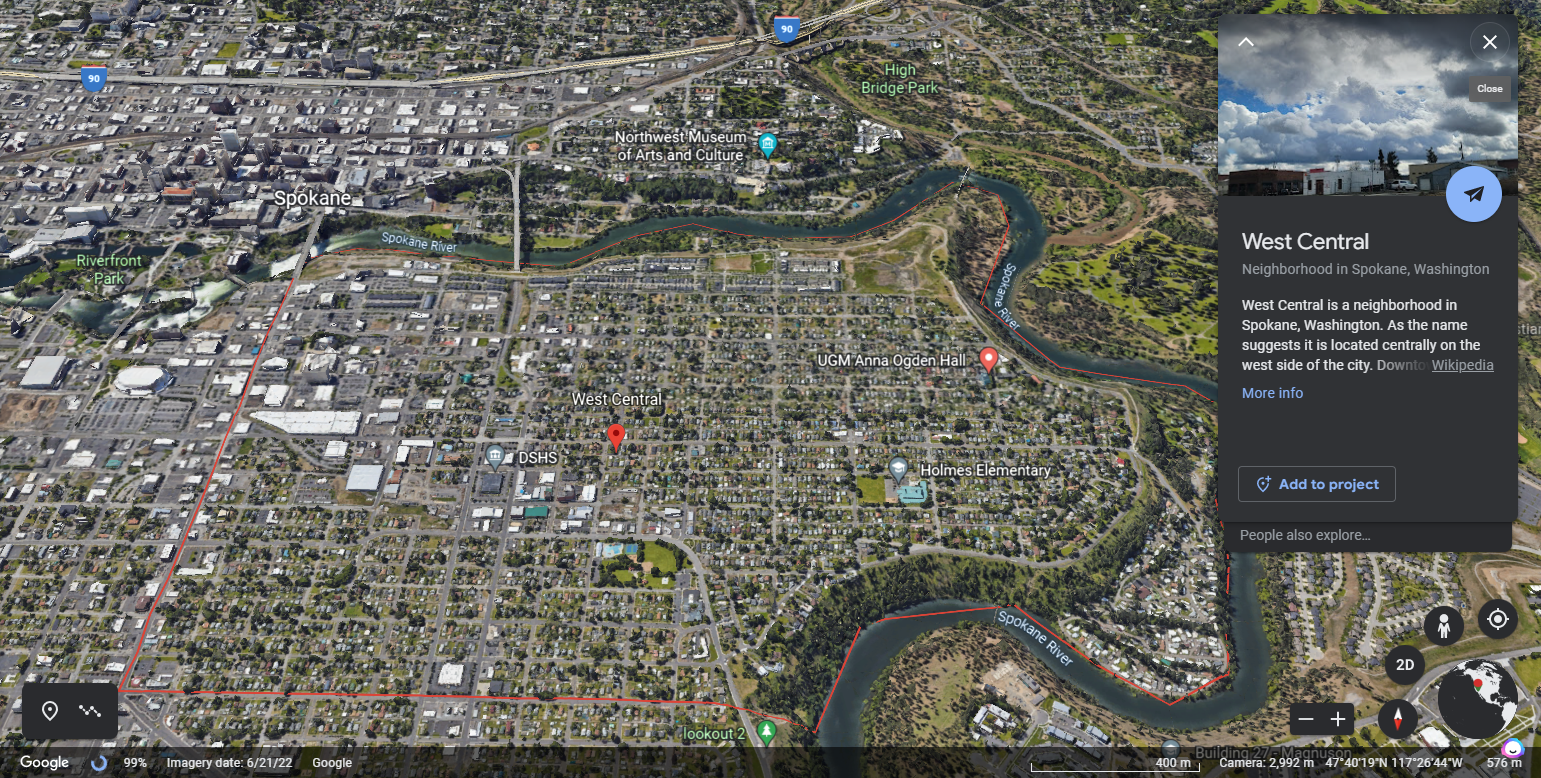

The one that took first place was the West Central neighborhood but I have a big caveat for that one that I’ll get into in a second.

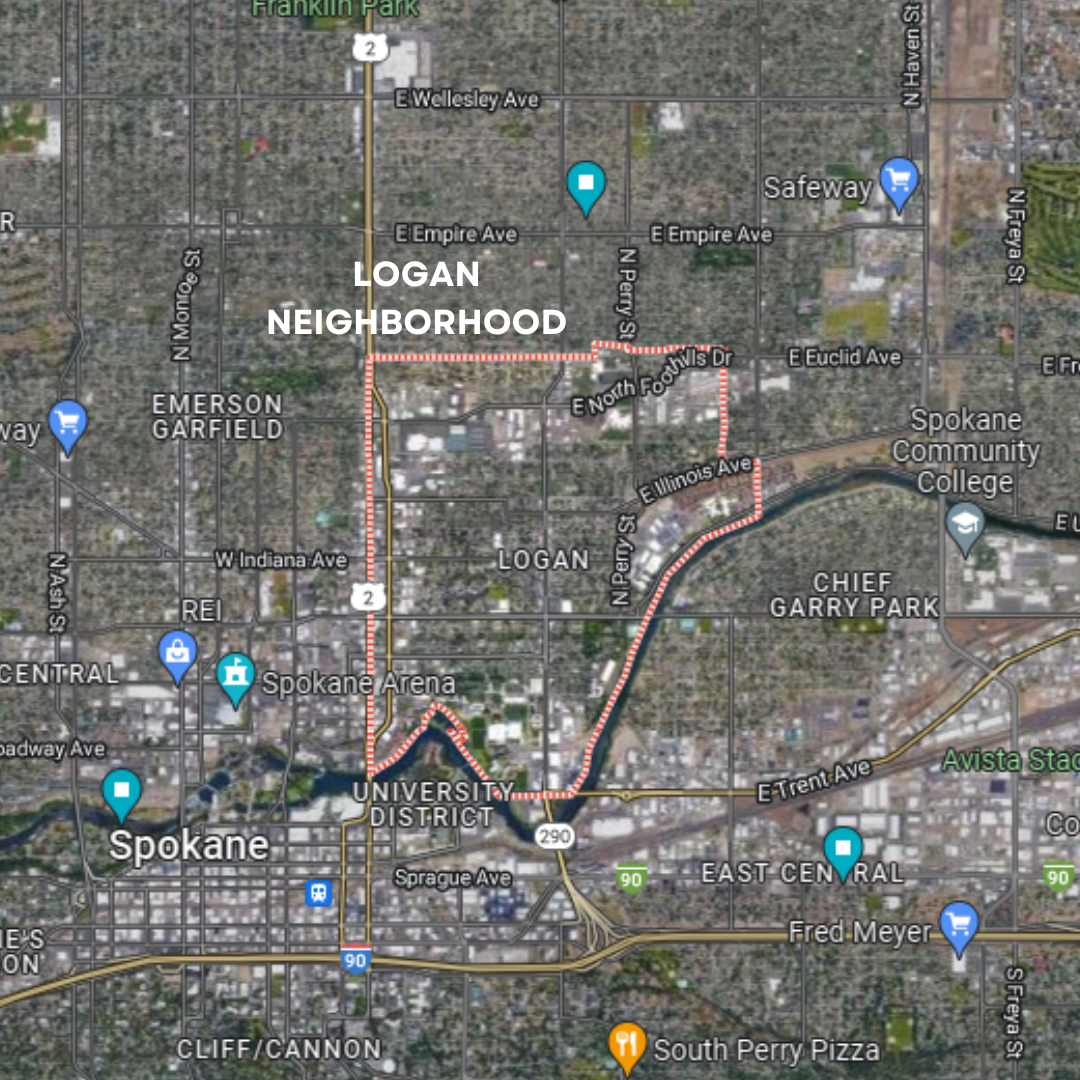

The three other neighborhoods that tied for second place were the Logan neighborhood, Garland and Northtown, and the Audubon neighborhood all at an average rate of .62%, which is pretty far off from that 1% rule as you can see. And in case I didn’t already tell you how we find if a property hits the 1% rule, you just divide the expected monthly rental rate by the purchase price of the property.

So what is my big caveat to West central? Well West central is a very subdivided neighborhood in itself because there’s a very distinct line between the brand new apartments and townhomes of Kendall Yards, and the older homes and multifamily to the north of that. So I think the rental rates could be skewed a little high because of the nice, new buildings in Kendall Yards while the property values are lower in this older neighborhood. It seems like very specific streets in this area, mostly the ones just a block or two north of Kendall yards actually do pretty well. College Avenue in specific definitely can demand a higher rental rate but still be homes that are more characteristic of the older West Central neighborhood.

So now that you know where to buy, there’s a few points I want you to keep in mind as you’re searching for your next property.

The first thing is you need to memorize the median home price for the location you like and find the largest house you can as close to that median price. As you can see, in most neighborhoods you’re getting to closer to that one percent rule by doing this and it really is kind of an obvious statement. If you can find a larger than average home for the neighborhood but at the average price, then you’re probably doing pretty well. Where you’ll really make your money is to find a home that is maybe only a 2 bed 1 bath right or maybe a 3 bed 1 bath that you can add an additional bath and bedroom to. This way you’re paying for a smaller home that you can put some sweat equity into and require higher rents than.

And even with all that said, the next thing to remember is the largest house isn’t always the best. And just to clarify, I’m not talking about homes that 4000 sq feet, but large meaning 4 bed, 2 bath maybe 2500 square feet on the high end.

But if we take a look back at the data, in some neighborhoods smaller homes are demanding more rent than larger homes. For example, a 3 bed 2 bath in Hillyard gets more rent than a 4 bed 2 bath in Hillyard. This shows that there’s more demand for this type of housing over the additional fourth bedroom and it might be easier to rent out a 3 bedroom in this area specifically. So make sure to take a look at any patterns like that so you can find a home that is easy to fill. When it comes to the long term rental game, it’s generally better to stick with a boring house that’s similar to the others because it’s predictable versus a short term rental where you might go for the unique property that provides more of an experience.

So even though rental rates went up about 21% last year, they never got to a point of exceeding the 1% rule here in Spokane but hopefully this information helps you narrow down what areas you’re most likely to find positive cashflow as you start your investing journey.

Categories

- All Blogs (805)

- Airway Heights (4)

- Audubon/Downriver (4)

- Balboa/South Indian Trail (5)

- Bemiss (3)

- Browne's Addition (3)

- Buying Your Home in Spokane (188)

- Cheney (3)

- Chief Garry Park (3)

- Cliff-Cannon (3)

- Colbert (1)

- Comstock (4)

- Dishman (3)

- Driving Tours (1)

- East Central (3)

- Emerson/Garfield (3)

- Five Mile Prairie (5)

- Grandview/Thorpe (3)

- Greenacres (3)

- Hillyard (3)

- Home Improvement (8)

- Home Prices (5)

- Housing Inventory (6)

- Housing Market (131)

- Instagram Videos (2)

- Interest Rates (24)

- Job Market in Spokane (3)

- Know Spokane (504)

- Latah Valley (5)

- Liberty Lake (8)

- Lincoln Heights (4)

- Logan (3)

- Manito-Cannon Hill (3)

- Medical Lake (4)

- Minnehaha (3)

- Moran Prairie (3)

- Mortgage (26)

- Moving out of Spokane (3)

- Moving to Spokane (141)

- Nevada/Lidgerwood (3)

- New Construction Opportunities (3)

- North Hill (3)

- North Indian Trail (4)

- Northwest (3)

- Opportunity (3)

- Peaceful Valley (3)

- Riverside (3)

- Rockwood (4)

- Selling Your Spokane Home (146)

- Shiloh Hills (3)

- Southgate (3)

- Spokane Events (361)

- Spokane Neighborhoods (51)

- Spokane Restaurants/Food Places (24)

- Spokane Schools (12)

- Spokane Valley (14)

- Suncrest (1)

- Things to Do in Spokane (374)

- Veradale (3)

- West Central (3)

- West Hills (3)

- Whitman (3)

- Youtube Videos (49)

Recent Posts