When Will Home Prices Come Down?

As the market continues to shift, more and more questions are being asked about how home prices will behave in the coming months. Will home prices continue to rise, or will they finally start to come down? If you’ve been interested in selling your home and/or buying a new one but have been intimidat

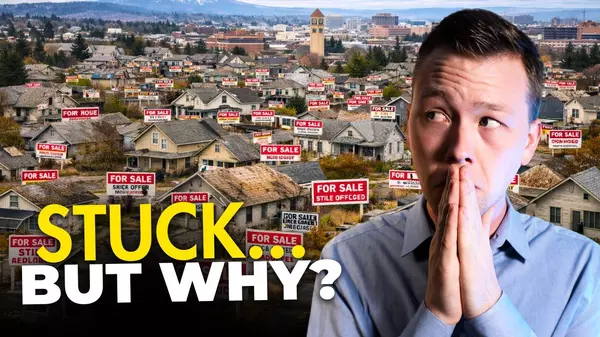

Massive Change in the Spokane Housing Market!

The landscape of Spokane housing could change forever. After a couple intense years in the housing market here in Spokane, major changes have begun to take effect in order to combat the continuously challenging housing market, both in the rental and resale space. We’ve seen headline after headline

3% vs. 5% vs. 7% – Navigating the Real Estate Math in Today's Market

You may have heard that changing market conditions have created a seller's market that's forcing buyers to spend a lot of money. People in many areas are experiencing housing shortages that make the seller's market strong. When you don't have enough supply to meet demand, you can expect to pay highe

Categories

- All Blogs (910)

- Airway Heights (5)

- Audubon/Downriver (4)

- Balboa/South Indian Trail (5)

- Bemiss (3)

- Browne's Addition (3)

- Buying Your Home in Spokane (207)

- Cheney (3)

- Chief Garry Park (3)

- Cliff-Cannon (3)

- Colbert (1)

- Comstock (4)

- Cost of Living in Spokane (1)

- Dishman (3)

- Downtown Spokane (1)

- Driving Tours (1)

- East Central (3)

- Emerson/Garfield (3)

- Five Mile Prairie (5)

- Grandview/Thorpe (3)

- Greenacres (3)

- Hillyard (3)

- Home Improvement (8)

- Home Prices (5)

- Housing Inventory (6)

- Housing Market (133)

- Housing Market Update (2)

- Instagram Videos (2)

- Interest Rates (24)

- Job Market in Spokane (3)

- Know Spokane (608)

- Latah Valley (5)

- Liberty Lake (8)

- Lincoln Heights (4)

- Living in Spokane (2)

- Logan (3)

- Manito-Cannon Hill (3)

- Medical Lake (4)

- Minnehaha (3)

- Moran Prairie (3)

- Mortgage (26)

- Moving out of Spokane (3)

- Moving to Spokane (143)

- Nevada/Lidgerwood (3)

- New Construction Homes in Spokane (1)

- New Construction Opportunities (3)

- North Hill (3)

- North Indian Trail (4)

- Northwest (3)

- Opportunity (3)

- Peaceful Valley (3)

- Riverside (3)

- Rockwood (4)

- Selling Your Spokane Home (163)

- Shiloh Hills (3)

- Southgate (3)

- Spokane Events (447)

- Spokane Neighborhoods (51)

- Spokane Restaurants/Food Places (24)

- Spokane Schools (12)

- Spokane Valley (14)

- Suncrest (1)

- Things to Do in Spokane (460)

- Veradale (3)

- West Central (3)

- West Hills (3)

- Whitman (3)

- Youtube Videos (49)

Recent Posts