Maximizing Home Equity: Your Key to Unlocking Your Dream Home

Homeownership is a significant milestone for many individuals and families, providing stability and a sense of accomplishment. Beyond the emotional benefits, owning a home can also be a wise financial investment. As property values appreciate over time, homeowners can build substantial equity. In this blog, we will delve into the concept of equity, explore how it can help you achieve your goals, and discuss how a skilled real estate agent can guide you through leveraging your equity in today's dynamic market.

Understanding Equity

Equity is the difference between the market value of your home and the outstanding balance on your mortgage. Put simply, it represents the portion of your property that you truly own. As you make mortgage payments and experience price appreciation, your equity grows. This equity can become a valuable asset that can be utilized to accomplish various goals.

Harnessing Your Equity

a) Upsizing or Downsizing: Your evolving lifestyle needs may lead you to consider moving to a larger or smaller home. Regardless of the direction, your accumulated equity can be a powerful tool. When selling your current home, the equity you've built can serve as a substantial down payment for your next property, giving you greater buying power.

b) Funding Life Milestones: Equity can also be used to finance significant life events, such as education expenses, starting a business, or supporting retirement plans. By tapping into your home equity, you can leverage the value you have built up to fulfill these goals.

c) Home Improvements: Investing in home improvements not only enhances your living space but can also increase the value of your property. With a healthy amount of equity, you can fund renovations or upgrades that will further boost your home's worth.

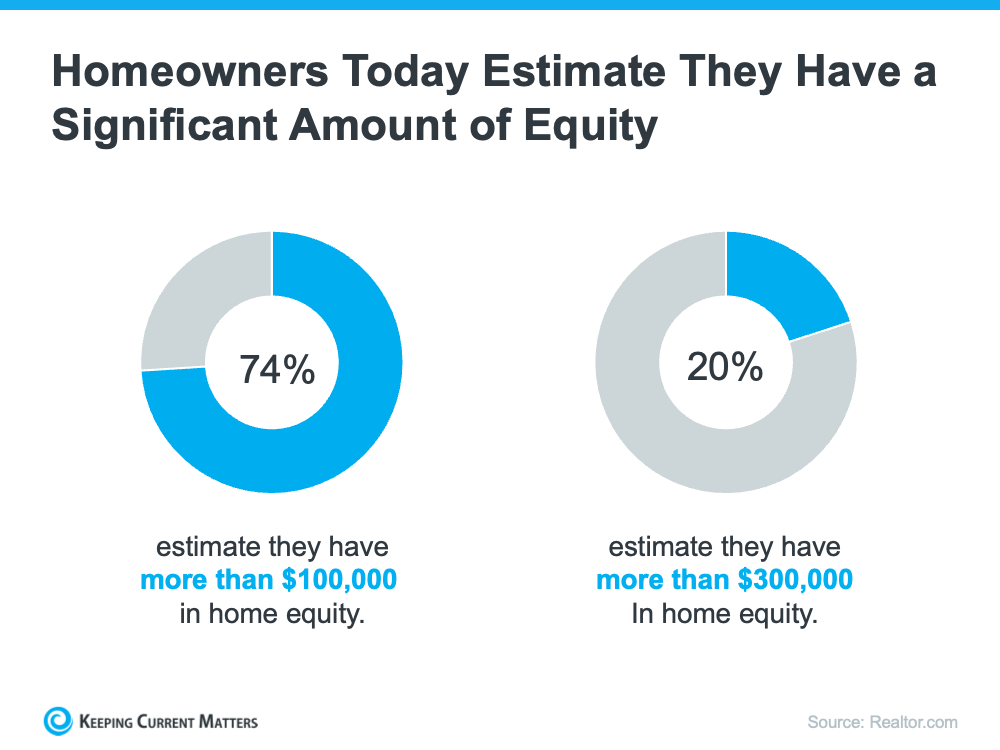

The latest data from CoreLogic helps solidify why homeowners are feeling so good about the equity they’ve likely gained over time. As Selma Hepp, Chief Economist for CoreLogic, says:

The Power of Home Equity Today

Recent data from reputable sources, like the National Association of Realtors and CoreLogic, highlights the considerable equity gains homeowners have enjoyed. Despite market fluctuations, homeowners in the United States, on average, have around $270,000 in equity – a substantial increase of approximately $90,000 since the onset of the pandemic. This growth in equity provides homeowners with newfound opportunities to achieve their aspirations.

The Role of a Skilled Real Estate Agent

Partnering with a knowledgeable real estate agent is essential when it comes to understanding the value of your home and effectively leveraging your equity. A skilled agent can provide you with a realistic estimate of home prices in your area, enabling you to accurately calculate your equity and determine your net proceeds. Their expertise in the market ensures that you make informed decisions throughout the process of selling your home and guides you on how to utilize your equity effectively.

As a homeowner, you have likely built up a significant amount of equity in your property. This equity can be a powerful tool that allows you to accomplish your goals, whether it's moving into a larger home, downsizing, funding important life events, or making improvements to your current property. A trusted real estate agent can help you assess the value of your home, estimate your equity, and guide you through the complexities of selling and buying a home. By understanding and leveraging your equity wisely, you can take confident steps toward realizing your dreams and securing your financial future.

Categories

- All Blogs (882)

- Airway Heights (5)

- Audubon/Downriver (4)

- Balboa/South Indian Trail (5)

- Bemiss (3)

- Browne's Addition (3)

- Buying Your Home in Spokane (202)

- Cheney (3)

- Chief Garry Park (3)

- Cliff-Cannon (3)

- Colbert (1)

- Comstock (4)

- Dishman (3)

- Downtown Spokane (1)

- Driving Tours (1)

- East Central (3)

- Emerson/Garfield (3)

- Five Mile Prairie (5)

- Grandview/Thorpe (3)

- Greenacres (3)

- Hillyard (3)

- Home Improvement (8)

- Home Prices (5)

- Housing Inventory (6)

- Housing Market (133)

- Instagram Videos (2)

- Interest Rates (24)

- Job Market in Spokane (3)

- Know Spokane (581)

- Latah Valley (5)

- Liberty Lake (8)

- Lincoln Heights (4)

- Logan (3)

- Manito-Cannon Hill (3)

- Medical Lake (4)

- Minnehaha (3)

- Moran Prairie (3)

- Mortgage (26)

- Moving out of Spokane (3)

- Moving to Spokane (142)

- Nevada/Lidgerwood (3)

- New Construction Homes in Spokane (1)

- New Construction Opportunities (3)

- North Hill (3)

- North Indian Trail (4)

- Northwest (3)

- Opportunity (3)

- Peaceful Valley (3)

- Riverside (3)

- Rockwood (4)

- Selling Your Spokane Home (158)

- Shiloh Hills (3)

- Southgate (3)

- Spokane Events (424)

- Spokane Neighborhoods (51)

- Spokane Restaurants/Food Places (24)

- Spokane Schools (12)

- Spokane Valley (14)

- Suncrest (1)

- Things to Do in Spokane (437)

- Veradale (3)

- West Central (3)

- West Hills (3)

- Whitman (3)

- Youtube Videos (49)

Recent Posts