Spokane Housing Inventory has Exploded!

In just over 3 months, Spokane’s housing inventory has more than tripled. What does this mean for you as a buyer or a seller? Today we’re talking about the shift that’s taking place in not only the Spokane housing market, but the housing market across the entire United states as well.

We’ve seen inventory skyrocket lately as well as interest rates and my goal in making this video is not to bore you with all the numbers and stats but help you make educated decisions when buying and selling real estate right now. So what does this all mean?

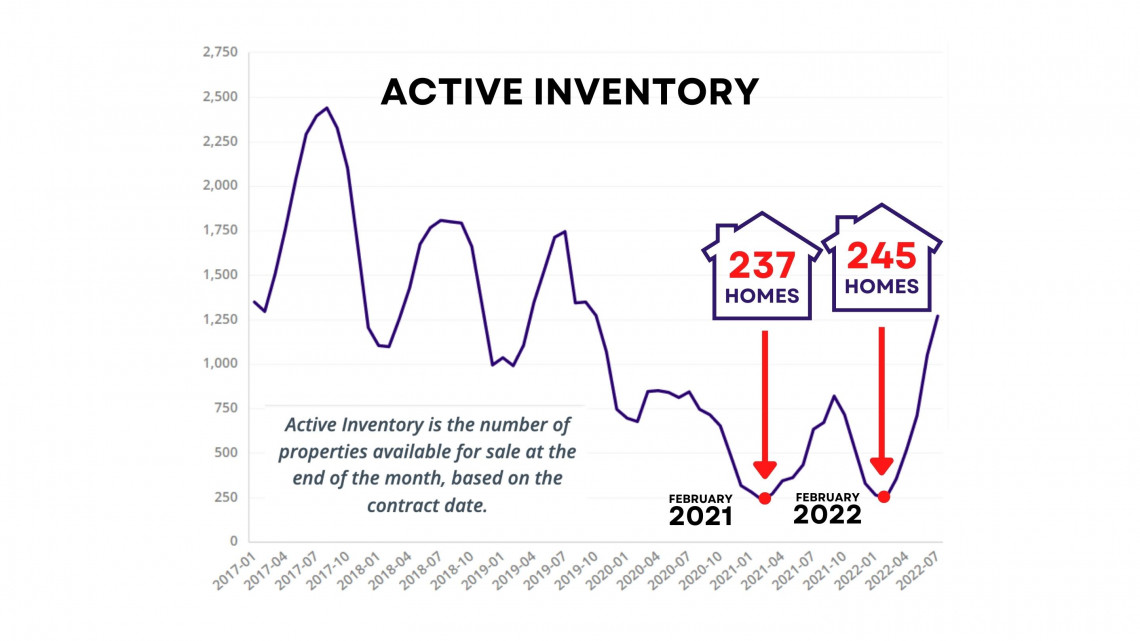

The beginning of 2022 was similar to 2021 in which we really saw the rock bottom of inventory in Spokane. In February of 2021 we saw an active inventory of 237 homes and in February of 2022 we saw 245 homes in active status.

.jpg?w=1140)

Now there are some seasonality factors as Spokane usually has the lowest amount of inventory in February every year anyway, but this was the lowest amount of inventory we’ve seen in Spokane pretty much ever.

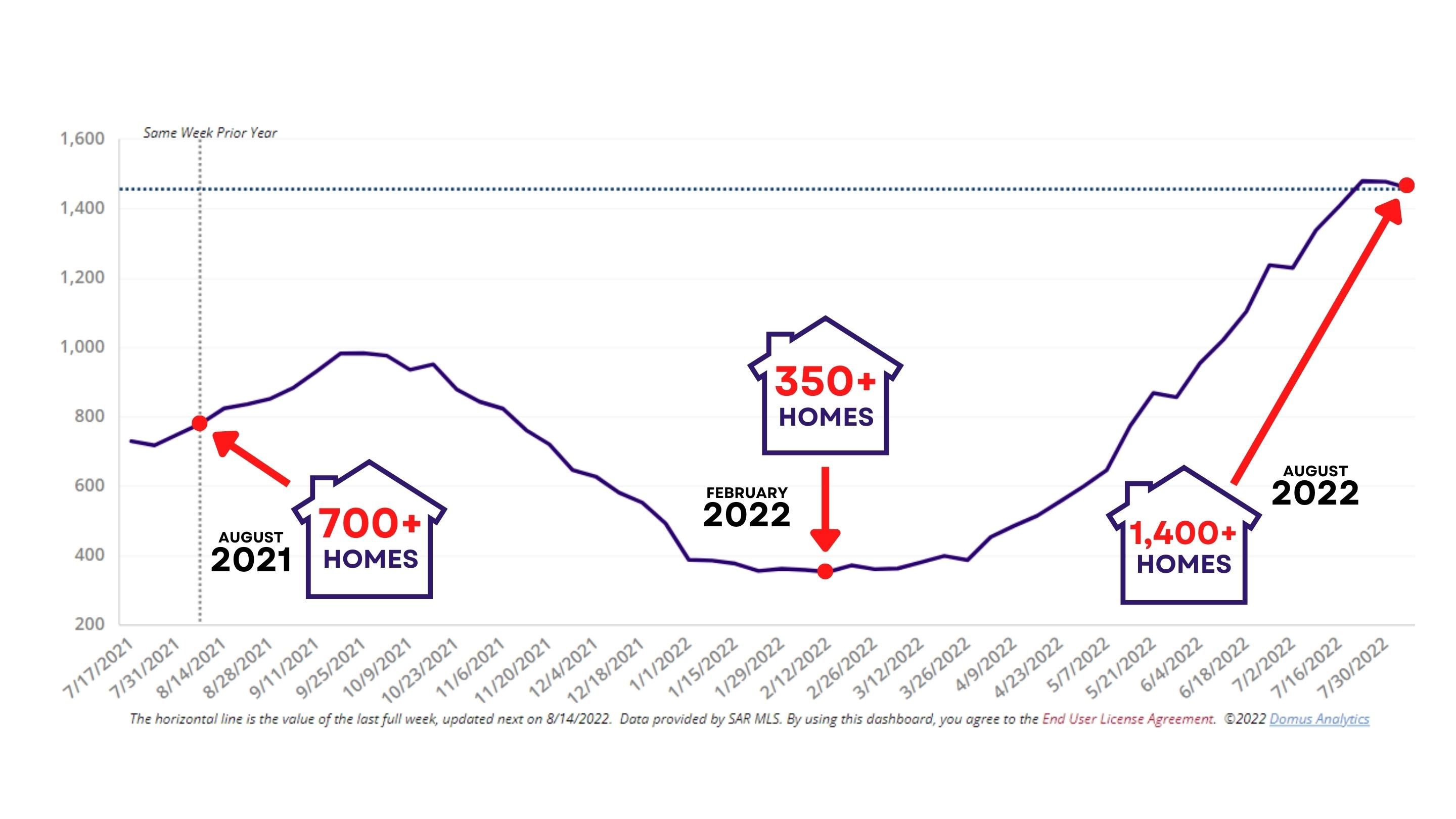

But in the span of 3 to 4 months we went from less than 400 active listings to now over 1400 active listings so we’ve made a significant jump. And even in comparison to this same week last year, we have a 93% increase in active listings.

.jpg?w=1140)

So why are homes sitting longer on the market? Well as most of us know, interest rates have gone up significantly from the start of the year as well. They were in the 3’s went up over 6% and are now back down in the 5’s.

This has caused the buyer pool to dry up because between the appreciation we’ve continued to see this year along with those rising interest rates, many buyers who could afford a $400,000 home last year, can now only buy a $300,000 home. And not to mention that a $300,000 home was worth $275,000 less than 6 months ago.

So the supply and demand scale use to look like this and now it looks a little more like this.

Now because we’ve seen such a rapid change in the housing market, this has caused media outlets to start using the word crash and bubble even though we are still nowhere near that point.

It’s common for us realtors to talk about how lucky all you home buyers are because historically interest rates are still low because back in the 1980’s they were easily 18%. Well houses were also a quarter of what they are now and on average housing affordability was a lot greater compared to the income of that time.

So even though I often believe that history repeats itself and that we should look back in history to help make decisions for the future, I don’t think most of you relate or feel comforted by the data from forty years ago. I know for myself I wasn’t even born yet and my parents hadn’t even made it out of high school yet, so let's look at a time that we should all be fairly familiar with, 2018 and 2019.

A time when interest rates were around 5%, homes could take anywhere from 2 to 5 months to sell, dropping the price was a normal thing to do and some homes just didn’t sell.

Compared to today, homes might take 3 to 4 weeks to sell so much quicker than 3 years ago, interest rates are in the 5’s, and price reductions are become a normal part of doing business.

So maybe one of you out there can explain it to me, but I don’t know what there is to panic about? What’s the difference between the two? Honestly, it seems like we’re still in a better place than we were 3 years ago.

Now we could stay on this trajectory but we’re just heading back to where we were pre pandemic. And You want to know what’s interesting? Well You know that recession that we’re in right now, if we’re calling it a recession, that has caused your stocks or 401K to go down by about 20%? Well it’s very similar to the real estate market. Real estate has really been more of a lagging indicator of the economy. The stock market has reacted much faster than the real estate market which is totally normal. You can sell your stocks at the push of a button but a home sale takes much longer.

But stocks were here at the end of 2019, beginning of 2020 and they had a wild ride but ended way up here in 2021 and have moved down to about the halfway point between 2019 and 2021.

The real estate market is having a similar journey. It was here in 2019, made its way up here in 2021 and now so far we’ve only seen a slight dip in prices and activity. But you know what will continue to happen to both stocks and real estate? Over time, they will continue to keep going up and up like they always do.

So just know that the housing market might have a little more room to move to meet up with the stock market, but all these people waiting for home prices to tank and foreclosures to flood the market are just going to be waiting forever. Because even if it does come down a bit more, the gap between there and what was going in 2019 is still a major difference. Home prices would literally have to be cut in half to go back to what they were in 2019.

.jpg?w=1140)

Okay, so what does this mean for you and your situation?

For Buyers, this time in the market is really good for you. Even though interest rates are higher and your monthly payment might go up, you’re able to do something that most buyers haven’t been able to do in the last two years, which is negotiate.

And even though your monthly payment might be a little higher, I think you’re going to be able to keep a lot more money in your pocket to get into your next home.

Sellers are offering concessions so they will cover your closing costs which could save you 2% or more of the purchase price in cash. For an average home in Spokane, that could be 7, $8000 that you get to keep in your pocket because the seller is going to cover it. Sellers are also offering interest rate buydowns which depending on how much you can negotiate could bring your interest rate down quite a bit and make your monthly payment much more affordable. If something comes up in the inspection, which you should feel blessed that you’re getting an inspection at all, you will actually be able to talk to the seller about getting it fixed instead of knowing they will move on to the next buyer because there is a line of people waiting for your deal to fall apart.

Additionally, being able to pay above the appraised value of a home with cash was a requirement so people with very deep pockets were winning all the bidding wars because they had a spare, 20, 30, even 50 thousand dollars in cash they could pay above the appraised value.

This is a fantastic time to get into the market if you don’t have tons of money saved up because the cash required out of pocket is much less.

.jpg?w=1140)

As a seller, you need to be ready for those negotiations. It probably won’t be a feeding frenzy any more where people just throw money at you, waive all contingencies and are willing to kiss your feet or name their first child after you to get into the house.

What is your plan to make your house stand out from the one down the street that is for sale and nearly identical to yours? Are you going to offer the interest rate by down from the start?

This leads to the next major change in the market which is creating a strategy with your realtor. When you first meet with your realtor you want to know what is the strategy to get a solid deal on a house right now or what is the strategy to get your house sold for the most money possible?

In the last year you could definitely just stick a sign in the yard and expect multiple offers but now much more work needs to go into making sure the house is clean, staged, well presented in photos and videos and there is a plan in place for pricing including price drops. Some of the very beautiful homes that are priced well are still experiencing multiple offers. I had a listing that is closing tomorrow that got 4 offers on it and 3 being cash but the sellers had done a beautiful renovation and priced the home well. So buyers, you still want to know what to do in the event of a multiple offer scenario.

.jpg?w=1140)

So, I think one of the biggest takeaways is that sellers, it’ll be slightly harder to find a buyer for your home, but not insanely difficult with the right plan.

Buyers, it’ll probably be easier to get your offer accepted.

But here’s what I’ve seen the most recently. Sellers still have a big ego because of the market we’re leaving, and buyers have a big ego because of the market we are entering, meaning both parties are going to have to work a lot harder to keep a deal together and across the finish line.

Partner up with an agent that can work for you but also help you make smart decisions that will benefit you but not totally kill a deal because you’re trying to take everything you can get.

I want to make this very clear though, the only thing that is going to go down is the rate of appreciation.

So that means that instead of homes appreciating 20% or more in a single year, they might only appreciate 3 to 5% in a year. And if you passed elementary school math, you can see that this means that home prices will still be going up year over year. Price reductions don’t reflect the entire market so please don’t let those scare you if you’re seeing them happen more and more. Asking price and value are two different things.

We Can Help

Whether you’re a home seller or a home buyer looking to navigate these turbulent real estate market conditions, our team of expert real estate professionals can help. We are skilled at negotiating home prices and working with clients during volatile times. Let's Talk

Categories

- All Blogs (834)

- Airway Heights (5)

- Audubon/Downriver (4)

- Balboa/South Indian Trail (5)

- Bemiss (3)

- Browne's Addition (3)

- Buying Your Home in Spokane (194)

- Cheney (3)

- Chief Garry Park (3)

- Cliff-Cannon (3)

- Colbert (1)

- Comstock (4)

- Dishman (3)

- Driving Tours (1)

- East Central (3)

- Emerson/Garfield (3)

- Five Mile Prairie (5)

- Grandview/Thorpe (3)

- Greenacres (3)

- Hillyard (3)

- Home Improvement (8)

- Home Prices (5)

- Housing Inventory (6)

- Housing Market (132)

- Instagram Videos (2)

- Interest Rates (24)

- Job Market in Spokane (3)

- Know Spokane (533)

- Latah Valley (5)

- Liberty Lake (8)

- Lincoln Heights (4)

- Logan (3)

- Manito-Cannon Hill (3)

- Medical Lake (4)

- Minnehaha (3)

- Moran Prairie (3)

- Mortgage (26)

- Moving out of Spokane (3)

- Moving to Spokane (142)

- Nevada/Lidgerwood (3)

- New Construction Opportunities (3)

- North Hill (3)

- North Indian Trail (4)

- Northwest (3)

- Opportunity (3)

- Peaceful Valley (3)

- Riverside (3)

- Rockwood (4)

- Selling Your Spokane Home (152)

- Shiloh Hills (3)

- Southgate (3)

- Spokane Events (384)

- Spokane Neighborhoods (51)

- Spokane Restaurants/Food Places (24)

- Spokane Schools (12)

- Spokane Valley (14)

- Suncrest (1)

- Things to Do in Spokane (397)

- Veradale (3)

- West Central (3)

- West Hills (3)

- Whitman (3)

- Youtube Videos (49)

Recent Posts