Scaling New Heights: Exploring the Reasons Behind Skyrocketing Mortgage Rates

Many prospective homebuyers are currently concerned about today's mortgage rates. If you're considering buying a home for the first time or selling your current house to find a better fit for your needs, you might be pondering two important questions:

- Why are mortgage rates so high?

- When will rates go back down?

Let's delve into the context that can help address these questions:

Why are mortgage rates so high?

The 30-year fixed-rate mortgage is largely influenced by the supply and demand for mortgage-backed securities (MBS). Mortgage-backed securities are investment products that resemble bonds and consist of bundles of home loans and other real estate debt. They are purchased from banks that issue these loans. Investors in mortgage-backed securities essentially lend money to homebuyers.

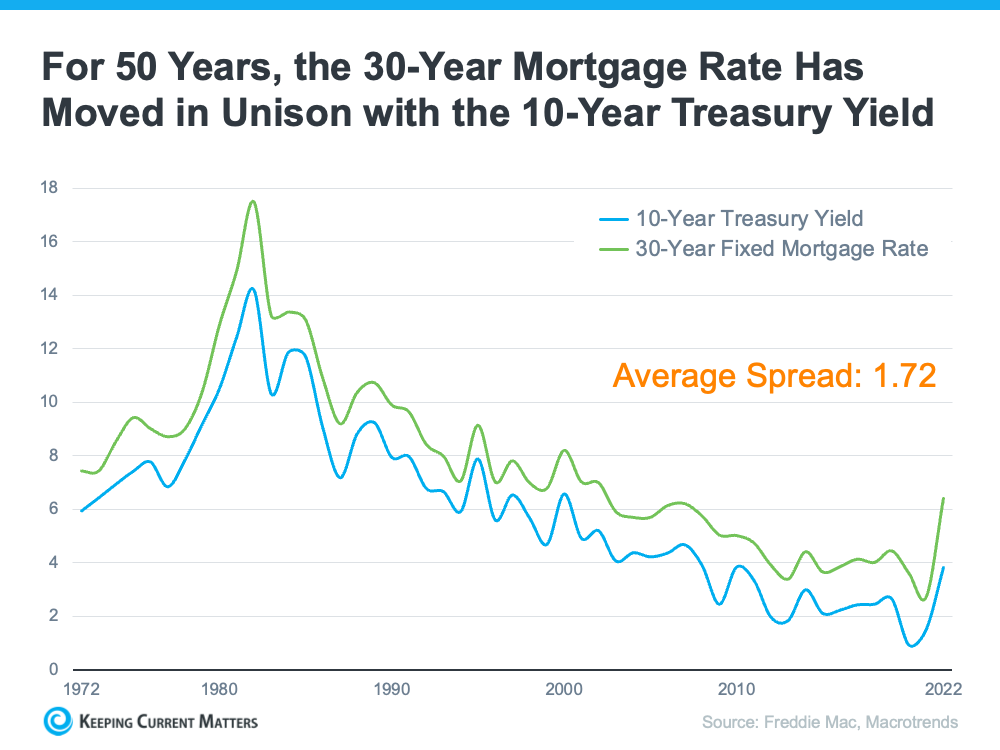

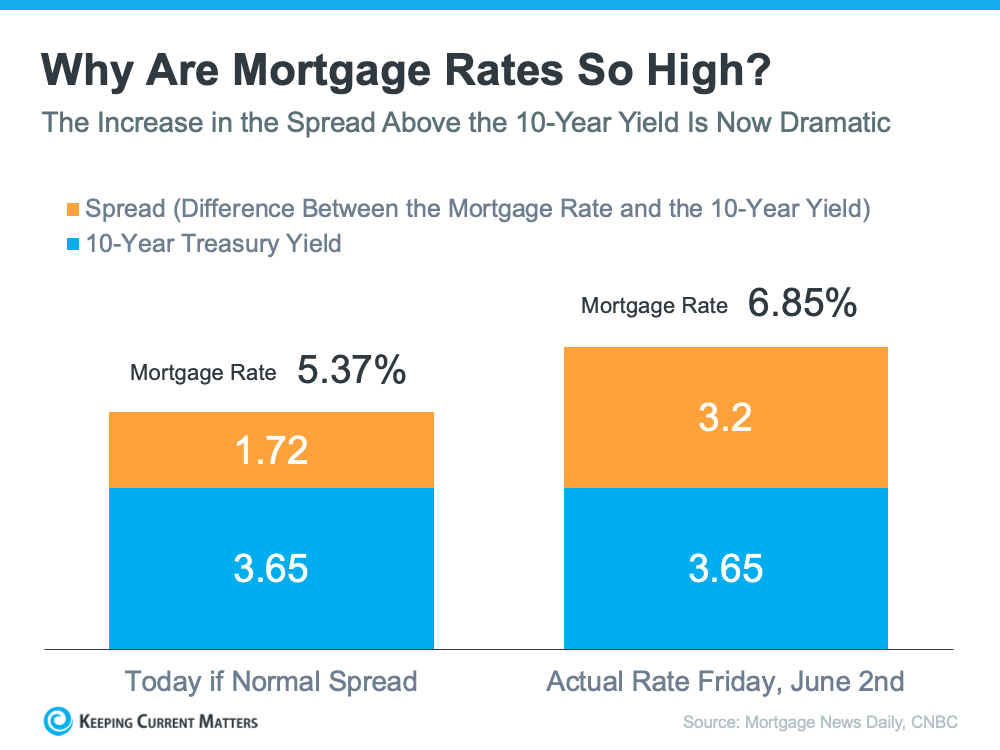

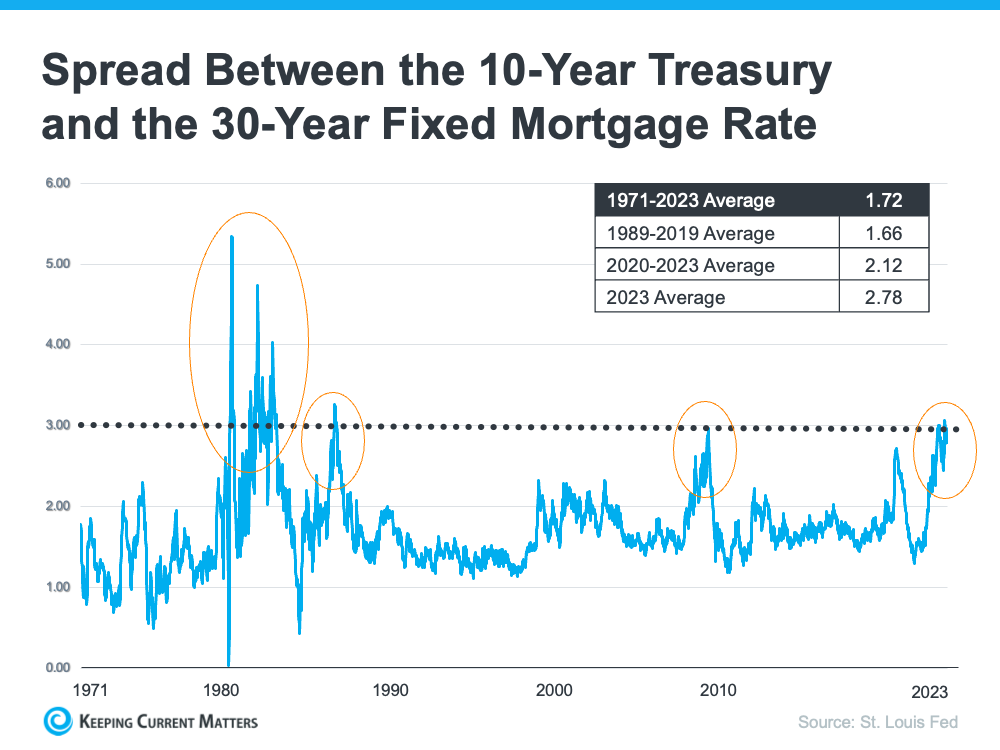

The demand for mortgage-backed securities plays a significant role in determining the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. On average, the historical spread between the two is 1.72%. However, as of last Friday morning, the mortgage rate stood at 6.85%, indicating a spread of 3.2%. This spread is nearly 1.5% higher than the norm. If the spread were at its historical average, mortgage rates would be 5.37% (3.65% 10-Year Treasury Yield + 1.72 spread).

Such a large spread is quite unusual. Typically, the spread approaching or exceeding 300 basis points has only occurred during periods of high inflation or economic volatility, such as the early 1980s or the Great Financial Crisis of 2008-09.

The graph below demonstrates the historical instances when the spread reached or surpassed 300 basis points:

The graph shows a pattern of the spread decreasing after each peak, which is good news as it implies that there is room for improvement in today's mortgage rates.

So, what factors are contributing to this larger spread and the current high mortgage rates?

The demand for mortgage-backed securities is heavily influenced by the risks associated with investing in them. Presently, these risks are influenced by broader market conditions, including concerns about inflation, the potential for a recession, the Federal Reserve's interest rate hikes aimed at curbing inflation, negative narratives surrounding home prices, and more.

In essence, when there is less risk, the demand for mortgage-backed securities increases, leading to lower mortgage rates. Conversely, higher risk reduces the demand for mortgage-backed securities, resulting in higher mortgage rates. Currently, the demand for mortgage-backed securities is low, hence the high mortgage rates.

When will rates go back down?

According to Odeta Kushi, Deputy Chief Economist at First American, it is reasonable to expect that the spread and, consequently, mortgage rates will decrease in the second half of the year if the Federal Reserve eases its monetary tightening measures and provides investors with more certainty. However, it is unlikely that the spread will return to its historical average of 170 basis points, as certain risks are likely to persist.

In summary, as investor fears subside, the spread will shrink, leading to a moderation of mortgage rates throughout the year. However, accurately predicting mortgage rates is challenging, and no one can be certain about what exactly will occur.

In conclusion, while the expectation is that mortgage rates will improve as the year progresses, it's important to keep in mind that no one can definitively forecast future mortgage rate movements.

Categories

- All Blogs (883)

- Airway Heights (5)

- Audubon/Downriver (4)

- Balboa/South Indian Trail (5)

- Bemiss (3)

- Browne's Addition (3)

- Buying Your Home in Spokane (203)

- Cheney (3)

- Chief Garry Park (3)

- Cliff-Cannon (3)

- Colbert (1)

- Comstock (4)

- Dishman (3)

- Downtown Spokane (1)

- Driving Tours (1)

- East Central (3)

- Emerson/Garfield (3)

- Five Mile Prairie (5)

- Grandview/Thorpe (3)

- Greenacres (3)

- Hillyard (3)

- Home Improvement (8)

- Home Prices (5)

- Housing Inventory (6)

- Housing Market (133)

- Housing Market Update (1)

- Instagram Videos (2)

- Interest Rates (24)

- Job Market in Spokane (3)

- Know Spokane (582)

- Latah Valley (5)

- Liberty Lake (8)

- Lincoln Heights (4)

- Logan (3)

- Manito-Cannon Hill (3)

- Medical Lake (4)

- Minnehaha (3)

- Moran Prairie (3)

- Mortgage (26)

- Moving out of Spokane (3)

- Moving to Spokane (142)

- Nevada/Lidgerwood (3)

- New Construction Homes in Spokane (1)

- New Construction Opportunities (3)

- North Hill (3)

- North Indian Trail (4)

- Northwest (3)

- Opportunity (3)

- Peaceful Valley (3)

- Riverside (3)

- Rockwood (4)

- Selling Your Spokane Home (159)

- Shiloh Hills (3)

- Southgate (3)

- Spokane Events (424)

- Spokane Neighborhoods (51)

- Spokane Restaurants/Food Places (24)

- Spokane Schools (12)

- Spokane Valley (14)

- Suncrest (1)

- Things to Do in Spokane (437)

- Veradale (3)

- West Central (3)

- West Hills (3)

- Whitman (3)

- Youtube Videos (49)

Recent Posts