Capitalize on Today's Limited Housing Inventory

Wondering if now is the right time to sell your house? The answer remains a resounding yes! Especially when you consider the current scarcity of available homes for sale. Current Scarcity While you may have heard about the low inventory situation, the true extent and benefits for potential sellers

Housing Market Forecast for the Rest of 2023

As we move into the latter half of 2023, the housing market remains a focal point of interest for homeowners, buyers, and investors alike. The past year has been marked by fluctuations and uncertainties, but what lies ahead for the real estate sector? Let's dive into the expert forecasts and examine

The Frenzy Is Over But Buyer Demand Remains Strong

In the ever-evolving housing market, 2023 has brought about significant changes, but homebuyer activity remains surprisingly strong. Despite a slowdown from the previous year's record-breaking surge, buyers are actively touring properties, reflecting a gradual return to a more balanced real estate l

Categories

- All Blogs (877)

- Airway Heights (5)

- Audubon/Downriver (4)

- Balboa/South Indian Trail (5)

- Bemiss (3)

- Browne's Addition (3)

- Buying Your Home in Spokane (201)

- Cheney (3)

- Chief Garry Park (3)

- Cliff-Cannon (3)

- Colbert (1)

- Comstock (4)

- Dishman (3)

- Driving Tours (1)

- East Central (3)

- Emerson/Garfield (3)

- Five Mile Prairie (5)

- Grandview/Thorpe (3)

- Greenacres (3)

- Hillyard (3)

- Home Improvement (8)

- Home Prices (5)

- Housing Inventory (6)

- Housing Market (133)

- Instagram Videos (2)

- Interest Rates (24)

- Job Market in Spokane (3)

- Know Spokane (576)

- Latah Valley (5)

- Liberty Lake (8)

- Lincoln Heights (4)

- Logan (3)

- Manito-Cannon Hill (3)

- Medical Lake (4)

- Minnehaha (3)

- Moran Prairie (3)

- Mortgage (26)

- Moving out of Spokane (3)

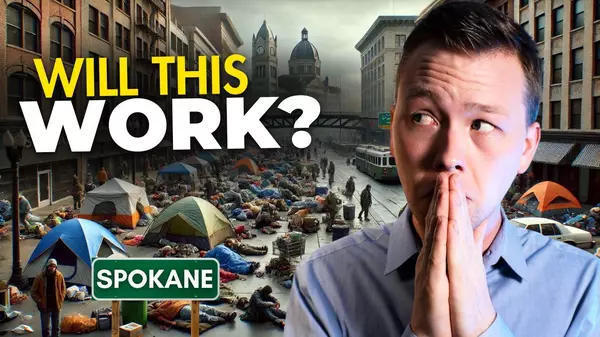

- Moving to Spokane (142)

- Nevada/Lidgerwood (3)

- New Construction Homes in Spokane (1)

- New Construction Opportunities (3)

- North Hill (3)

- North Indian Trail (4)

- Northwest (3)

- Opportunity (3)

- Peaceful Valley (3)

- Riverside (3)

- Rockwood (4)

- Selling Your Spokane Home (157)

- Shiloh Hills (3)

- Southgate (3)

- Spokane Events (420)

- Spokane Neighborhoods (51)

- Spokane Restaurants/Food Places (24)

- Spokane Schools (12)

- Spokane Valley (14)

- Suncrest (1)

- Things to Do in Spokane (433)

- Veradale (3)

- West Central (3)

- West Hills (3)

- Whitman (3)

- Youtube Videos (49)

Recent Posts